Beginner's Guide to Tax Filing in the USA: Insights and Recommendations

前言| Introduction

在美國,直到滿24歲之前,小孩的稅務都可以由父母上報。也是直到滿24歲後,我才開始了解到美國報稅制度。雖然我不是會計師,無法提供更深入的介紹,但這篇文章主要是要簡單分享一下我的報稅經驗。希望能多少幫助到一些和我一樣成年沒多久的新移民們。

簡單來說,美國的報稅時間通常從每年的1月份開始,截止至當年的4月15日。在這段期間,居住在美國的民眾需要準備報稅資料並分別填寫聯邦(Federal Taxes)和州稅表(State Taxes)。內容大致主要包括去年的收入(薪資、股票等)和扣除額(捐款、貸款等)。如果需要延長報稅期限,可以在4月15日之前提交一份申請,將截止日期延長至當年的10月15日。

如果繳納稅額大於計算出來的報稅金額,則會在報稅過後獲得退款至個人帳戶。反之,如果納稅額度少於應繳納的金額,則需補稅。

In the United States, parents can file their children's taxes until they reach the age of 24. So, it wasn't until I turned 24 that I began to understand how tax returns work in the United States. Since I'm not an accountant, I cannot offer an in-depth explanation. This article is primarily written to simply share my tax filing experience. Hopefully, it can provide some insights to new immigrants who have to start filing tax returns themselves.

In short, tax filing in the United States typically begins in early January and ends on April 15th each year. During this period, U.S. residents need to prepare their tax documents and complete both federal and state tax forms. The tax return forms would include last year's income (such as salaries, stocks, etc.) and deductions (like donations, loans, etc.). If a resident seeks a tax extension, an application can be submitted before April 15th to extend the deadline to October 15th of the same year.

If the amount paid exceeds the calculated tax amount, a refund will be deposited into the individual's account after filing taxes. Conversely, if the tax paid is less than the amount owed, additional tax will be required.

認識美國報稅網站| Getting to Know Free Guided Tax Software/Websites

#IRSFreeGuidedTaxSoftware

如果在美國擁有長久居住的資格(例如綠卡和公民),美國的國稅局(Internal Revenue Service,簡稱IRS)官網其實有列出可以免費網路報稅的軟件/網站 (請見右圖並點選"Explore Free Guided Tax Software [探索免費稅務申報軟件]”)。

需注意的是這免費申報的軟件只適用於(調整後的)總收入(Adjusted Gross Income)為$79,000 或以下的居民。至於什麼是”調整後的總收入”,你可以大致的解讀成扣稅後的實拿收入金額,而非稅前的收入。如果工作沒有換的話,這個總收入可以從去年的稅表中找到。

如果自己本身的稅款並沒有特別複雜的話(純粹只有薪資單和股票收入),我覺得自己報稅其實算是最經濟實惠的選擇。根據網站指示填入金額就可以很直白的知道自己的退稅額有多少。

If you have permanent residency status in the United States (such as a green card or citizenship), the official website of the Internal Revenue Service (IRS) actually lists out free online tax filing software/websites (please see the image on the right and click "Explore Free Guided Tax Software").

It's important to note that these free filing software are only applicable to residents with an Adjusted Gross Income (AGI) of $79,000 or less. As for what "Adjusted Gross Income" means, you can roughly interpret it as your net income after tax deductions, rather than the gross income before taxes. If you haven't changed jobs, you can find this adjusted gross income on your last year's tax return.

If your tax situation isn't particularly complicated (for example, you only have salary income from a job and other income from stocks), I think filing your own taxes is actually the most cost-effective option. You can simply follow the instructions on the website and enter the correct amounts based upon the tax forms you received, such as W-2 and 1099-B, and you can immediately find out how much your tax refund would be before you complete your tax filing.

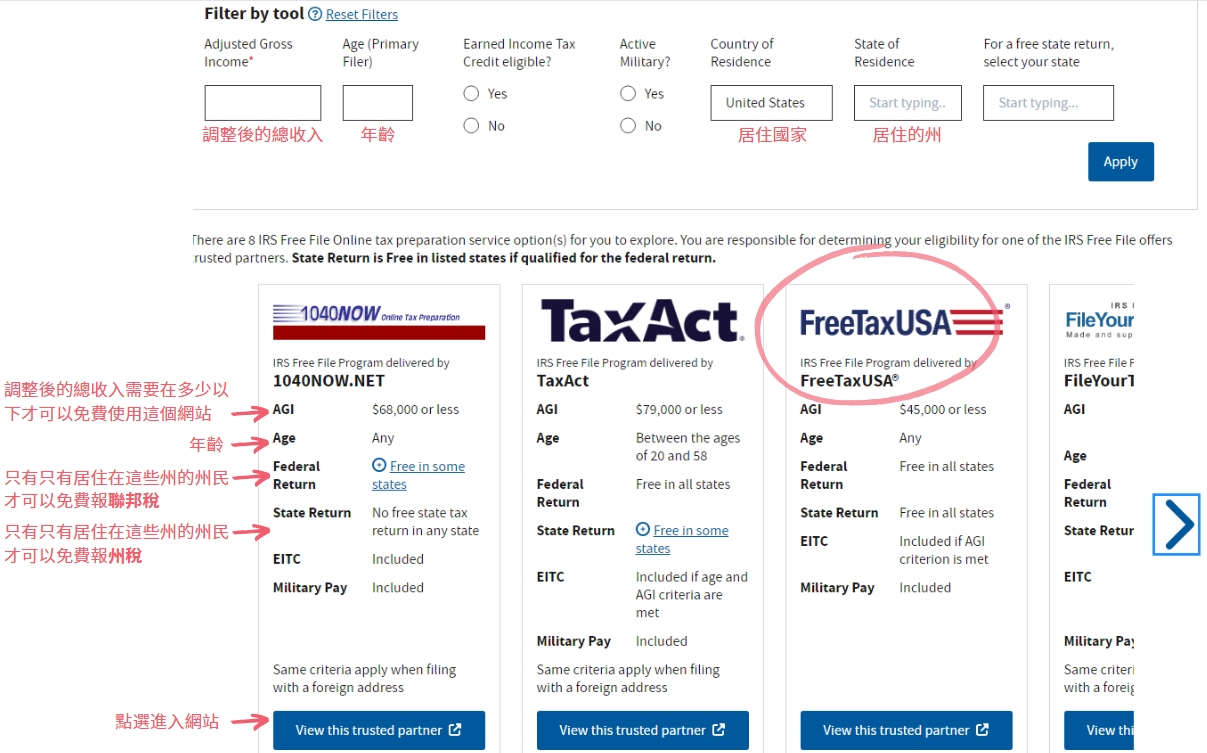

根據網站的指示並點選深藍色的按鍵,會進入到下方的這個頁面:

After you follow the instructions on the website by clicking the navy blue button, it will direct you to a page with a variety of free tax filing options shown below.

#IRSFreeGuidedTaxSoftware #Filter

可以使用頁面上方的過濾器填寫自己的總收入、年齡、居住國家、以及居住的州篩選出最適合自己的報稅網站。由於每個網站免費提供報稅的族群都有點不太一樣,所以可以用上方的過濾器快篩一下適合自己的。最近幾年,我試過用TaxAct和FreeTaxUSA這兩個報過聯邦和州稅。整體使用下來,我個人覺得FreeTaxUSA的網頁設計更簡單易懂,非常適合新手報稅使用。值得一提的是,如果你的總收入超過$45,000,也還是可以免費使用FreeTaxUSA報聯邦稅,唯一需要付款的只有報州稅的時候($14.99/州)。跟其他網站比起來,報州稅的價格算是相對較低的(例如,TaxAct報州稅會收$39.99/州)。唯一的缺點就是它只有少數的報稅表格可以用上傳pdf的方式自動填寫,不像是TurboTax可以無腦導入大部分的稅務單。

You can use the filters at the top of the page to input your adjusted gross income, age, country of residence, and state of residence, allowing you to refine the search for the most suitable tax filing website for your needs. Each website offers free tax filing for slightly different groups, so these filters help you quickly pinpoint the one that best fits your circumstances.

In recent years, I've tried both TaxAct and FreeTaxUSA for filing federal and state taxes. Overall, I found FreeTaxUSA's website design to be simpler and more user-friendly, making it particularly suitable for beginners. It's worth noting that even if your total income exceeds $45,000, you can still file your federal taxes for free using FreeTaxUSA, and you'll only need to pay when filing state taxes ($14.99/state). Compared to other platforms, the price for filing state taxes using FreeTaxUSA is relatively low (for example, TaxAct charges $39.99/state for state tax filing). The only drawback is that it only supports uploading PDFs for filling out a few tax forms automatically, unlike TurboTax, which can seamlessly import most tax documents.

進入報稅網站只需要註冊帳號就可以立即使用,根據指示上傳各個稅務表格(例如,1095、1098、1999、W2等),或者手動填寫表格內容,系統會自動將資料填入報稅表格中。如果有工作的話,年初會從公司收到W-2表格,可以選擇上傳pdf檔案又或者手動填寫W-2表格內容。如果有股票收入,則會根據情況有1099-B、1099-INT和1099-DIV這三大類的稅務單。

You can easily set up a new account to begin filing your tax return through the tax filing website. As illustrated below, the website is designed to lead you through the tax filing process, starting with inquiries about your yearly salary income, stock earnings, and more. By following the prompts, you can either upload various tax forms or manually enter their details, and the system will then automatically populate the tax return forms for you by the end. If you're employed, you'll receive a W-2 form from your employer at the start of the year, which you can upload as a PDF file or fill out manually. Additionally, if you earn income from stocks, you typically receive three types of tax forms based on your circumstances: 1099-B, 1099-INT, and 1099-DIV.

#FreeTaxUSA

結語|Conclusion

如果你是非居民的外國人(non-resident alien),報稅方式會與持有長期居留資格的居民不同。我看網路上很多人都推薦留學生使用OLT這個網站報稅,由於我自己本身沒有使用過,我在這裡就不做過多的闡述了。但就根據經驗而談,我個人覺得自己報稅還是有一定的優勢所在。網路報稅也節省下了很多時間,退稅金額會直接匯進銀行帳戶,也能直接在網上追蹤進度。所以還挺建議大家試試看IRS網站上推薦的納些軟件。

If you are a non-resident alien, your tax filing process will differ from that of residents with long-term residency status. I've noticed many people recommend using the OLT website for tax filing by international students online, but since I haven't used it myself, I won't elaborate on it here. However, based on my experience, I personally believe there are certain advantages to filing taxes independently. Online tax filing saves a significant amount of time, and the tax refund amount is directly deposited into your bank account. You can also track the progress online. So, I would recommend trying out some of the software recommended on the IRS website.

Join me on Instagram for more instant stories — follow along for daily updates!